Morgan Stanley published their much anticipated annual Swiss watch industry analysis earlier this month and we summarize the highlights below.

In 2020, Rolex, Omega, and Cartier, all maintained their long-held first, second, and third-place status — and that won’t be changing anytime soon. One of the three gained substantial market share in 2020 — despite the ongoing pandemic — and the title of the report “King Rolex” should give you a hint as to who that was.

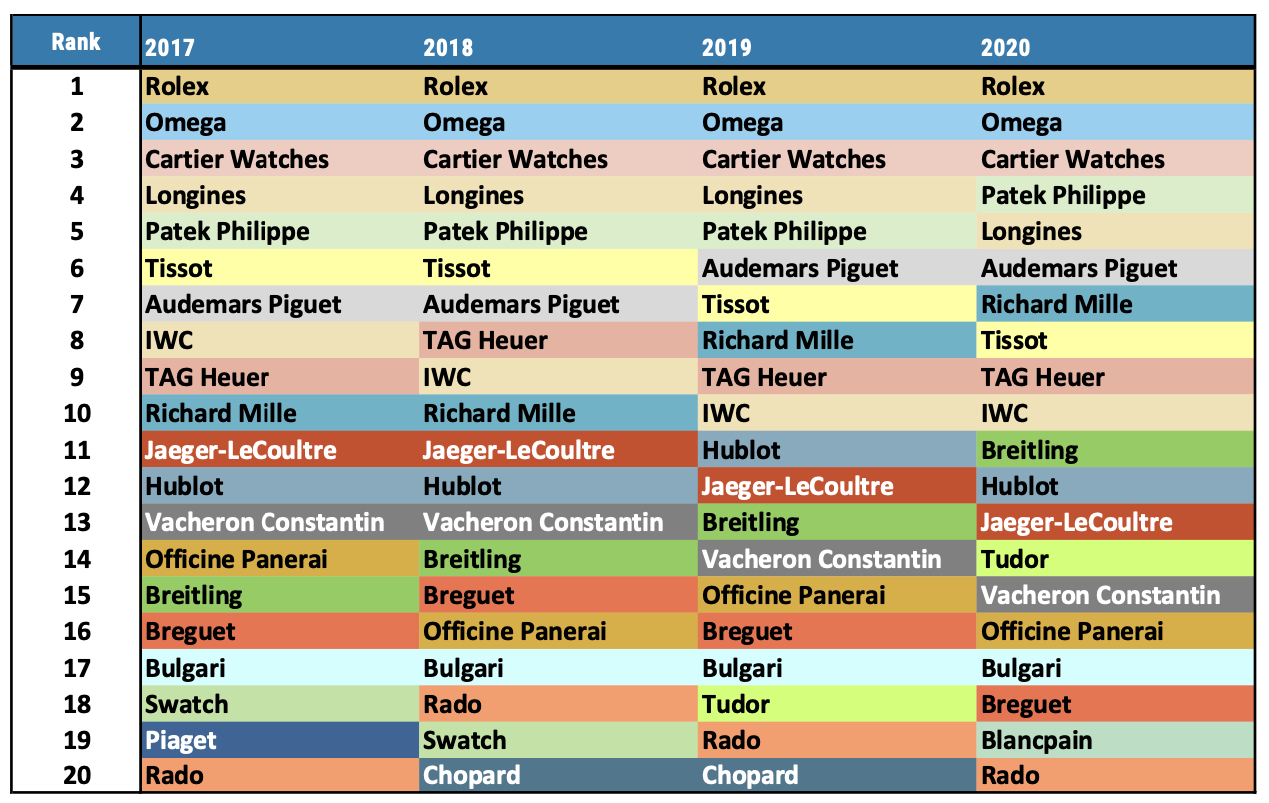

Patek Philippe took back the 4th spot from Longines in 2020. With Thierry Stern carefully executing the company’s long-term strategy — and after all the buzz they’ve created around the discontinuation of the Nautilus 5711 and its forthcoming replacement — Patek is poised to maintain this rank going forward.

Tudor has been building momentum for years, and now after not even making the top 20 in 2017 or 2018, they skyrocketed to 19th in 2019, and all the way to 14th in 2020. It’s hard to imagine Tudor slowing down considering the value they deliver for the price point and the association with their parent company Rolex.

Breitling has managed to move up one spot from 2017 to 2018, another spot from 2018 to 2019, and two spots from 2019 to 2020 — putting them in 11th place. That’s one spot back of rival IWC, which Breitling’s CEO, Georges Kern helmed for many years prior to leaving Richemont in 2017. In the past, Breitling held a higher position in the rankings, and the fact that they are climbing back shows that Kern’s turnaround strategy is having a positive effect. Considering the turnover numbers, marketing strategies, and price points, Breitling could overtake rivals such as IWC and TAG Heuer, in the next year or two.

The biggest fall was from Chopard, who dropped from the 20th spot in 2019 to 27th place in 2020. Covid was perhaps the main factor for the decline. Fundamentally, the products have to be able to generate strong demand from a brand perspective, though — and such a drop suggests that’s not happening.

With an estimated 24.9% share of the market, Rolex has grown even more dominant in 2020. Despite decreased sales from the pandemic, Rolex now owns an astonishing quarter of the entire Swiss watch market — with no signs of slowing down.

Omega has a strong assortment of new products, and will soon offer Master Chronometer certification on the entire collection. This could help bolster their total Swiss watch market share from 8.8% in 2020 into the double-digit range by 2021 or 2022.

Audemars Piguet and Richard Mille have similar distribution and pricing strategies and they sit at 6th and 7th, respectively. Their businesses are largely supply-based — similar to Rolex and Patek Philippe — except their distribution is completely the opposite. In fact, both are rumored to be in the process of eliminating their entire wholesale network of multi-brand retailers in favor of owning 100% of the distribution — giving them increased control and higher profits. Moreover, this year, both companies have invested in significant new partnership deals (with Marvel and Ferrari) which could catapult them even higher up the rankings — or waste capital without generating a significant return. No risk, no reward.

Source: LuxeConsult, Morgan Stanley Research.