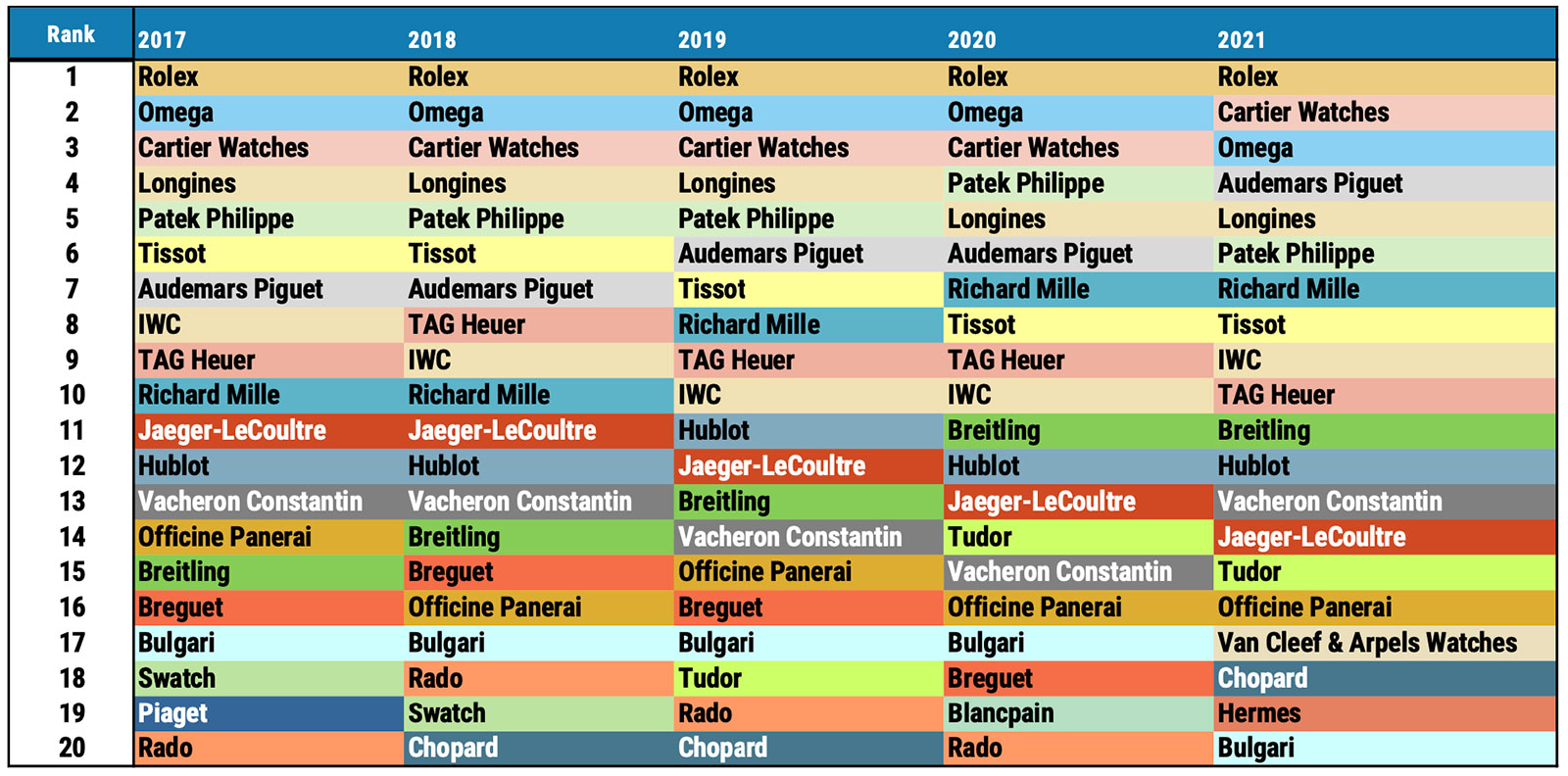

Morgan Stanley’s 2022 top 20 Swiss Watch Company Ranking for 2021 was released this month, and there have been a number of positional changes.

Surprising exactly nobody who follows the watch industry, Rolex has maintained its number one position. Rolex continues to dominate with a 28.8% Swiss watch exports market share (based on sales revenue), which is up from 24.9% last year. A share made even bigger when their entry-level Tudor brand’s sales are figured in — bringing the combined total share for the 2021 calendar year to over 30%. Rolex and Tudor together now represent practically a third of Swiss watch sales revenue.

What is rather surprising is that Cartier’s watch division has switched places with Omega, after years of dominance by Omega at the number two spot. In spite of impressive double-digit gains by Omega, not to mention a larger market share, Cartier’s gains during the 2021 calendar year were even greater, moving the Richemont Group-owned brand into the number two position.

Even with the rotation of sales revenue rankings, the positions stayed the same based on share with Rolex capturing (28.8% share), Omega (7.5% share), and Cartier (6.9% share). Omega lost 1.3% of its market share from 2020 to 2021, while Cartier gained 0.2% market share. Regardless of whether you look at sales revenue or market share, the top three Swiss watch brands have stayed in the top three, and are all still the respective cash cows of their groups — representing a staggering 43.2% share of all Swiss watch exports for 2021.

Another significant change in 2021, although not that surprising considering the demand for Royal Oaks, was Audemars Piguet, who has climbed from the number six position last year to number four this year (based on sales revenue). An impressive performance no doubt. Interestingly, while the sales revenue climbed — and is how the main rankings at the top of the page are calculated — Audemars Piguet’s market share dropped from 4.3% to 4.2%. With almost absolute control of its retail network, and therefore control of the supply, Audemars Piguet fully controls its own destiny.

Perhaps one of the most surprising positional changes of all during the 2021 calendar year, was Patek Philippe’s notable drop from number four to number six (based on sales revenue). However, it’s certainly worth noting that Patek Philippe improved their market share from 4.8% in 2020 to 5.8% in 2021.

Vacheron Constantin jumped two positions from 2020 to 2021, and with a new strategy (based on our own research) that has similarities to Audemars Piguet and Richard Mille — which is to micromanage the inventory to affect demand — it may already be working. Vacheron Constantin also increased its market share from 1.5% in 2020 to 1.9% in 2021.

The “Others” market share has decreased from 20.9% in 2020 to 20.4% in 2021, and this includes independents such as FP Journe, Laurent Ferrier, Voutilainen Armin Strom, and many other smaller brands, including mainstream players such as Oris and Zenith. We presume that not all companies were able to scale back up after losing production time during the pandemic, so while the share has decreased, it could well make a larger upward correction by the end of 2022.

Revenue ranking changes aside, the Swiss watch industry as a whole has improved significantly from 2020 to 2021 and has clearly shown its great ability to adapt to different crises around the world. Case in point, according to the Federation of the Swiss Watch Industry (FH), Swiss watch sales reached an all-time high of CHF 22.3 billion in 2021, up 31.2% from 2020.

For reference, please see our analysis from 2021, Morgan Stanley’s Top Swiss Watch Company Ranking for 2021.

Source: LuxeConsult, Morgan Stanley Research.

Editor’s note: All rankings are based on estimated sales revenue, not numbers directly reported by watch brands.