In this article, we’ll discuss the basics of wristwatch insurance and the best options that we’ve determined through research.

Overview

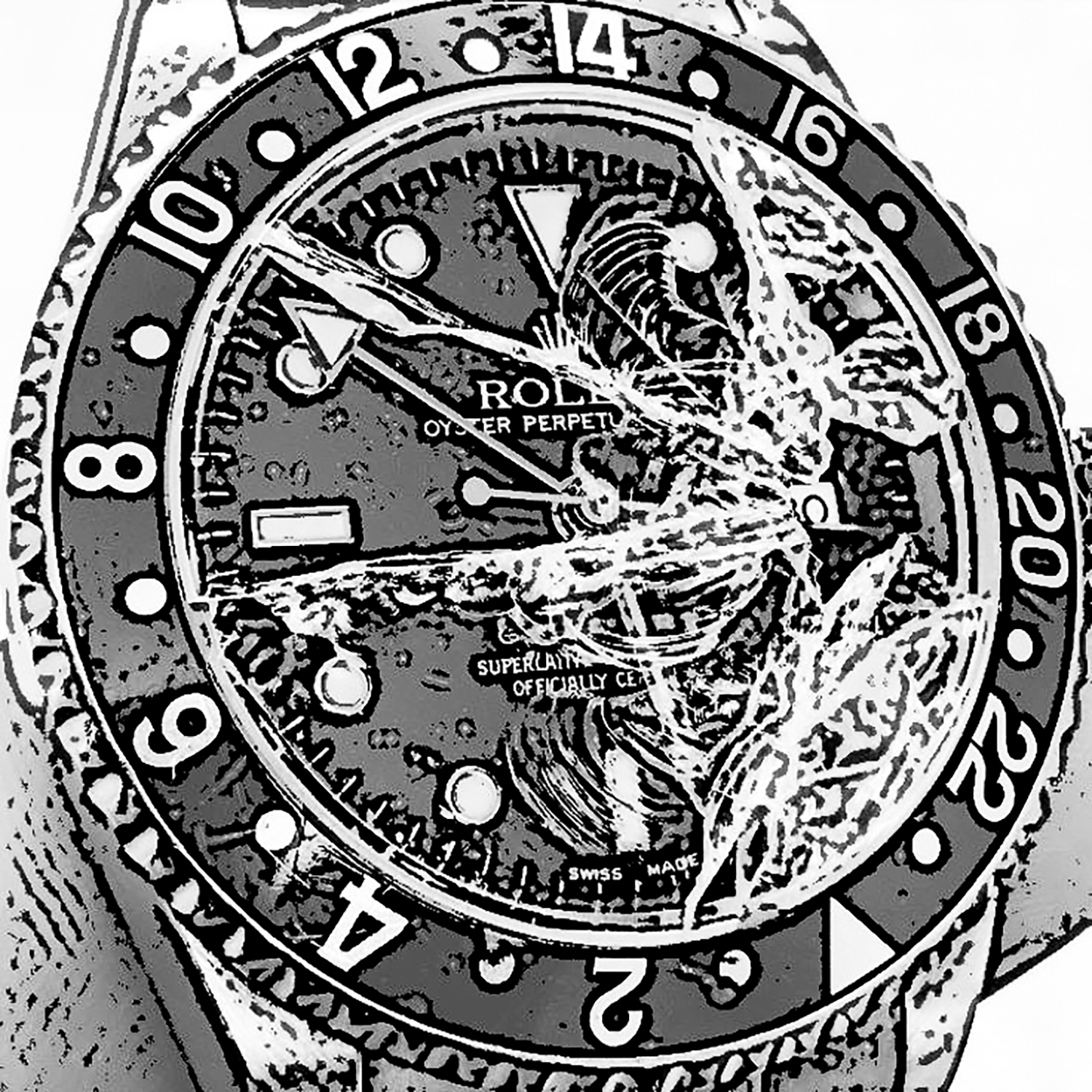

Wristwatch insurance helps protect your watch from loss, theft, robbery, damage, or other covered risks. Whether you own a luxury timepiece (like Rolex, Omega, or Patek Philippe) or a sentimental vintage watch, insurance offers peace of mind.

What Wristwatch Insurance Covers

Coverage depends on the provider and the policy, but typically includes:

Theft (from home, car, or while traveling)

Robbery (where the watch is forcibly taken from you)

Loss (accidental misplacement)

Damage (case damage, cracked crystal, water damage, mechanical failure)

Worldwide coverage (if you travel)

Mysterious disappearance (vanishes without explanation — not all policies include this)

Homeowners/Renters Insurance

Even if you schedule your watches specifically, in most cases, your homeowners or renters insurance will provide less coverage, require higher deductibles, and cost the same or more than dedicated watch insurance policies. Additionally, if your purchase receipt is not recent, a formal appraisal is almost always required. Doing an independent appraisal requires additional time and expense. If you make a claim, it can impact future policy prices. And making a claim requires a more cumbersome process compared to dedicated watch insurance.

Dedicated Watch Insurance

With dedicated watch insurance from Zillion, Wax Collect, Hodinkee, Lavalier, Jewelers Mutual, and BriteCo, policies are tailored specifically for watches. The deductible is typically zero dollars in the event of a loss. And you receive worldwide coverage. It’s often easier to get your watch appraised, in some cases for no charge. Watch insurance is more comprehensive and covers things like accidental damage and mysterious disappearance, anywhere in the world. Ultimately, watch insurance provides far more peace of mind, at a comparable rate, than scheduling watches on your homeowners/renters policy.

Cost of Dedicated Watch Insurance

Dedicated, standalone watch insurance typically costs 1% to 2% of the watch’s value annually. For example, insuring a $5,000 Rolex should cost between $50-100 per year. The rate depends on the Insured Watch Value, Location, and Deductible amount ($0 deductible is standard; however, you can save by increasing the deductible). Security measures, such as whether you have alarms and a home safe, can be a factor, depending on the methodology.

Requirements to Activate Watch Insurance

Typically, a receipt, serial number, and photos are enough. Sometimes a formal appraisal is needed, depending on the total insured value and the date of the purchase receipt. This is important to consider in the overall cost because an independent appraisal adds to the total cost.

Comparison of Wristwatch Insurance

The Professional Watches editorial team researched six primary watch-specific insurance providers in the US using a $5,000 insured value and Denver zip code as the constants for comparison.

1. Zillion ($56/year)

Awesome process. They pay out in the form of a new or pre-owned replacement watch, up to 125% of insured value, protecting against price increases. Zillion does not require appraisals for timepieces purchased from partner retailers. They may require appraisals for items purchased from non-partner retailers, depending on the origin and year of purchase — most often, a receipt will suffice. For partner retailers like Watches of Switzerland, it’s also just a seamless text at the point of sale. And when you walk out of the store, from Watches of Switzerland or a partner retailer, you’re given 10 days of temporary coverage instantly.

2. Wax Collect by Chubb ($73/year)

No instant quote (it arrives shortly after via email). The overall process was relatively effortless and streamlined. One of the best features of Wax Collect is that it does not require a formal appraisal for timepieces under $100,000. For insured values of $100,000 or higher, they refer you to a local provider and cover the cost of the formal appraisal. The payout is in cash, and your watches are insured for up to 150% of the original value, protecting against any price increases. Wax Collect has an app and is highly focused on watch collectors.

3. Hodinkee by Chubb ($73/year)

A login is required to sign up for Hodinkee insurance, meaning this service is designed for collectors who are part of the Hodinkee community. Like Wax Collect, Hodinkee only requires a formal appraisal at or above $100,000 of insured value. Hodinkee pays out in cash for the insured value, and can extend to up to 150% of the insured value if replacing an item requires it. This is very beneficial for serious collectors. The main difference between Wax and Hodinkee, despite both being underwritten by Chubb, is that Hodinkee is even more collector-focused and has a more robust app connected to it. Hodinkee also offers a dynamic policy, where you can add the whole collection, but only actively insure the watch you plan to wear.

4. Lavalier ($63/year)

Fast and easy quote process. It costs slightly more than Zillion, but less than Wax Collect, Hodinkee, or Jewelers Mutual watch insurance. This is a great, straightforward option.

5. Jewelers Mutual ($89-96/year)

One of the most expensive polices we found. We received two different prices, despite entering the same zip code and insured value each time, and both were the highest amongst the group. Ultimately, this is a good premium option from a longtime specialist watch and jewelry insurer; however, it does not focus as specifically on watches, like Zillion, Wax Collect, or Hodinkee.

6. BriteCo ($60-96/year)

BriteCo quickly provided a price range; however, to get an actual quote and secure the insurance, they have a cumbersome and highly intrusive process where they request your LinkedIn profile, employment information, and education information. Zillion, Wax Collect, Hodinkee, Lavalier, and Jewelers Mutual required no additional information like that.

Verdict

Zillion watch insurance is the most affordable option, has a streamlined process that’s seamless and requires no app, yet it’s highly focused on watches, making it one of the best options for mainstream timepiece owners, offering protection for up to 125% of the insured value. For more serious collectors, Wax Collect and Hodinkee watch insurance are a great option that pays out in cash and can extend up to 150% of the value if needed. Plus, these two have apps to go along with their policies. Lavalier is quick, straightforward, and offered the second-best price. Jewelers Mutual is a reliable standard option and has been in existence for over 100 years, although it also costs the most. BriteCo has an intrusive and cumbersome process akin to filling out a job application, and we recommend the other five options over BriteCo, for that reason alone.